So you’ve heard that NFTs are the latest rage in the investment world?

Are you asking yourself: Is NFT a good investment?

Well, it’s a good sign that you are doing your own research before you dive into this new investment opportunity.

As with all new asset classes, the rewards are high but so are the risks.

In this guide, we’ll explain under which conditions NFTs can be a good investment but also why they may not be a good idea for everyone.

Remember, you are here to invest and not to gamble.

Key Points (tl;dr)

- An NFT is a unique and immutable entry on a blockchain, represented visually in the form of a digital image, such as a piece of artwork.

- You can make money with NFTs either by buying in at a low price and selling it later at a higher price or by using your NFTs in innovative business models to generate passive income.

- NFTs are an extremely risky asset class, very similar to investing in early-stage startups with unproven business models.

- NFTs can be a good investment with proper due diligence. However, for the vast majority of retail investors, the risk-reward ratio isn’t good at all.

Like this content? Then share it!

The Truth: Is NFT a Good Investment?

www.tokenizedhq.com

Here’s the answer. Great article by @ChrisHeidorn right here: https://tokenizedhq.com/is-nft-a-good-investment/

Disclaimer: This Is Not Financial Advice

At the risk of sounding like a broken record, we do need to point out that all of the content in this article is purely for informational purposes. None of it is financial advice. NFTs are an extremely new asset class. If you thought cryptocurrency was risky, please be aware that NFTs are even riskier. Please make sure that you have done your own research before investing and never invest more than you are willing to lose. The vast majority of people will lose money in this market.

A Refresher: What Is An NFT?

NFT stands for “non-fungible token”, which basically means that it is unique or one-of-a-kind. While every Bitcoin is the same, each NFT is not. At their core, NFTs are simply an entry in a distributed and immutable database, which we call blockchain or distributed ledger.

Before we get into the nitty-gritty details of the question “Is NFT a good investment?“, let’s start with a little refresher on what NFTs actually are.

And if you’re still not clear on why NFTs are even relevant, I suggest you have a look at our guide that answers the question “Why do people buy NFTs?”

The part of an NFT that you usually see is the graphical representation of the token.

This can be any form of a digital image, such as a real piece of digital art or something that resembles a trading card or membership card.

If the image is a piece of digital art by a real-life artist and it’s one of his unique creations then you’re most likely dealing with proper artwork, just in digital form.

If the image is part of a massive collection with close to 10,000 different avatar-like images, then you are dealing with a so-called profile-pic (PFP) project.

The former is very similar to investing in traditional artists, the only difference is that your ownership is recorded on the blockchain.

The latter is more akin to buying shares in an early-stage startup.

Despite the fact that not every token within the collection has the same value, you’re usually buying into a project which is promising to deliver more than just artwork.

So now that we’ve discussed the visual aspects of an NFT, let’s get into what you are actually buying.

NFT stands for “non-fungible token”, which roughly translates into: A token that is unlike any other; it’s one-of-a-kind.

So how do you prove that it is one-of-a-kind?

Well, the NFT and all of its history are recorded on the blockchain, a form of a distributed ledger.

The blockchain is tamper-proof, so the entire history of a given token is public knowledge and stored forever (unless the network dies).

The token can also easily be traded between different parties in exchange for cryptocurrency.

So what does this mean?

When you buy an NFT, you are essentially buying an entry in a big, distributed, and public database.

And that is how everyone knows who, or at least which wallet, owns a particular asset.

The images you see are just visual representations of the asset.

The fact that someone can right-click and save that image doesn’t matter, because only you are the legitimate owner of the original and all of the benefits that it may come with.

For more details on potential use cases, please refer to our list of the top 10 examples of NFTs.

So is NFT art a good investment?

Well, let’s find out.

Can You Make Money With NFTs?

Yes, you can make money with NFTs. The most basic example of making money with NFTs involves buying them at a low price and selling them at a higher price for profit. This is essentially no different from trading stocks or cryptocurrency. Other ways to make money with NFTs involve innovative business models which allow you to generate passive income from your NFTs.

Why do you think people ask: “Is NFT a good investment?“

Well, most people are attracted to NFTs because they’ve heard that you can make a lot of money with NFTs.

So is it true? Can you make money with NFTs?

While this is absolutely true, it doesn’t mean that it’s necessarily easy to make money with NFTs.

There are many ways how to make money with NFTs, but for the purposes of this guide, we’ll stick to plain vanilla investing in NFTs by buying tokens.

The primary objective of these investments for most people is to sell them at a later date for a profit.

Day traders, also known as “flippers”, obviously have a shorter investment horizon than long-term investors.

However, some investors might also be looking to reap other benefits from their NFT investments.

So the question “Is NFT a good investment?” becomes a little more complex than just numbers.

These can be intangible benefits, such as status or exclusive club memberships.

Others can be quite tangible, such as royalties on future profits or yield from staking tokens.

But in the short term, nearly everyone is simply looking to buy low and sell high.

Are NFTs a Risky Investment?

NFTs are a very risky asset class. While cryptocurrencies are already considered to be very risky investments, NFTs are even further out on the risk curve. Here’s a helpful analogy: If investing in cryptocurrency is like buying growth stocks, investing in NFTs is like providing seed funding to early-stage startups, of which 99.9% fail (i.e. venture capital).

If you’ve invested in cryptocurrencies before, then you know that they tend to be very volatile in price and are considered very risky investments.

If you’re a crypto veteran then this might not scare you anymore but bear in mind that NFTs are even further out on the risk curve.

This is crucially important in order to answer the question: Is NFT a good investment?

Many projects are essentially using NFTs as a form of funding mechanism, which makes it very reminiscent of the ICO gold rush in 2017.

If buying a mainstream cryptocurrency feels like buying stocks to you, then NFTs are very similar to investing in early-stage startups with nothing but a community vibe and pretty pictures.

This is also why the NFT landscape is rampant with fraud and overwhelmed founding teams whose vision (aka NFT roadmaps) usually doesn’t ever materialize.

Some even go so far as to claim that NFT pyramid schemes have become the norm, which obviously is utterly false.

So is it good to invest in NFTs?

While cryptocurrencies have matured over the past few years, NFTs are still very new.

And unlike buying Bitcoin or Ethereum, the non-fungible aspect of NFTs is also the reason why they can be incredibly risky.

While it’s very easy to go on a crypto exchange and instantaneously liquidate most of your crypto investments, this isn’t the case with NFTs.

Since every NFT within a collection is slightly different, valuing them becomes a highly subjective process.

Objectively multiple NFTs might be of the same value, but the visual representation may not be to everyone’s taste.

The lack of “fungibility” in the market is why the market isn’t liquid at all.

That’s why the floor NFT price has become such an important indicator of the value of an NFT collection.

The only way to sell your NFT relatively quickly is to list it at the absolute floor price and perhaps even undercut it.

The problem with this is that there’s almost always someone else, who wants to sell his NFT even more urgently than you.

So panic kicks in and these panic sellers keep undercutting each other and pulling down the entire value of a collection.

The same thing can also happen in the other direction when a sudden surge in price will trigger FOMO (fear of missing out) amongst those who are looking to buy at a good price.

By now it’s probably become clear to you, what sort of risks you need to deal with in NFTs.

Nevertheless, this doesn’t necessarily mean that NFTs have to be a bad investment.

But is NFT a good investment for everyone?

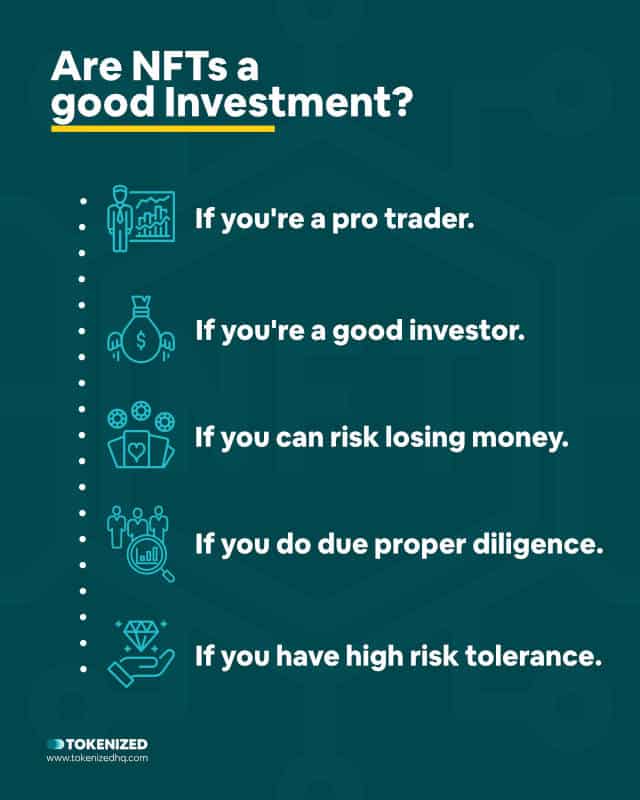

Is NFT a Good Investment?

NFTs can be a very good investment. An experienced trader or someone with a track record of identifying good investment opportunities stands a good chance of making considerable gains with NFTs if they do their homework. Inexperienced investors may also get lucky and hit a home run despite their lack of skills. However, for the vast majority of people, NFTs are most likely far too risky to be a good investment.

As with all investments, if you thoroughly research the risks and the opportunities associated with a project, then you stand a relatively good chance of making good investments.

We have a really good article here at Tokenized that teaches you what makes a good NFT project.

This assumes that you are also willing to wait at least a few years in order to give the founding team a chance to deliver on its promises.

So what’s important to know when responding to the question: Is NFT a good investment?

The earlier you invest in a project, the more risk you are taking on.

The fact that the buy-in price may be lower doesn’t necessarily mean that it’s less risky.

It just means that the market currently does not see sufficient value or a track record that would justify a higher price.

A high price also doesn’t necessarily mean that a project is better, especially if it’s merely the result of a short-term price swing.

Searching for particular rarities within a collection and thus spending significantly more than the current floor price is also something that only battle-tested investors should do.

If you fully understand the potential behind a project and a convinced that the team can also execute its plans, then buying into such a project at a fair market price can be an extremely good investment.

And in that case, the answer to “Is NFT a good investment?” is quite simply

It’s not unheard of that someone 5x or 10x their initial ETH investments within a matter of few months.

And this can be incredibly attractive to someone who also has a strong belief in the future of the underlying blockchain itself (usually this is Ethereum).

Imagine buying 1 ETH at $2,500 and using it to buy an NFT which triples in value within a few months.

You now have 3 ETH and if the price of Ethereum rises, you’ve got even more in dollar terms.

NFTs can be an extremely good investment but they are also extremely risky.

It’s the classic trade-off between risk and reward.

Conclusion

So, is NFT a good investment?

NFTs are a nascent technology that has led to an entirely new asset class.

Most use cases of NFTs are still very much focused around art and gaming, two industries that traditionally are at odds with the crypto scene and mostly despise NFTs.

If you think cryptocurrency is risky, please understand that NFTs are even riskier.

Nevertheless, for those who understand the game and are willing to take the risk, NFTs represent a unique opportunity to generate some significant gains.

If you decide to invest in NFTs, please remember that all this content is for informational purposes only and should not be considered financial advice.

Please do your own research before you buy any NFTs.

Here at Tokenized, we want to help you learn as much as possible about the coming NFT revolution. We help you navigate this fascinating new world of non-fungible tokens and show you how you can integrate tokenization into your own business.