Are you unsure about how to price your NFTs?

Perhaps you’re eager to start your own NFT project but don’t know what the optimal NFT pricing model is?

Listen, we get it because you’re definitely not alone and thousands of people are equally inexperienced when it comes to NFT pricing strategy or pricing in general.

In this guide, you’ll not only learn how to price your NFT project but also how to conduct market research in order to assess the market potential of your niche.

So let’s get started.

Key Points (tl;dr)

- Before you make any decisions on your NFT pricing strategy, make sure you’ve conducted sufficient research on what your direct peers did and how they performed within the respective market environments.

- Depending on whether you are an artist or a founder, clarify what exactly your objective is and be aware that the more you promise and the higher you price, the bigger the pressure will be on you to continuously deliver value to holders.

- NFT pricing models for artists can split into two rough categories. Unknown artists should start by pricing lower until they’ve gained a relevant following and some sales under their beld. Established artists can aim higher but they should try to stick to price levels at which they’ve sold before.

- For project founders the NFT pricing strategy is a largely a question of balancing between the initial raise and ongoing royalties. Bear in mind that asking to too much money on the initial mint while not having a track record will be seen as a red flag.

- Many people want ot know how to value your NFT. The value of NFTs is driven my multiple factors, some of which can be assessed objectively, while others are in the eye of the beholders and subject to herd mentality.

For detailed guidance on how to price your NFT project, PLEASE SCROLL FURTHER DOWN THE ARTICLE.

Like this content? Then share it!

The Truth: How to Price Your NFTs the Right Way

www.tokenizedhq.com

Here’s the answer. Great article by @ChrisHeidorn right here: https://tokenizedhq.com/how-to-price-your-nft/

How to Conduct NFT Market Research

In order to properly research the right price for your NFT launch, you must first scan the market and understand what other projects with similar objectives have done and how they have performed. It’s crucial that you establish which projects are your peers and what worked for them and in which environment they launched.

Before you decide on how to price your NFT it’s absolutely crucial that you conduct at least some basic market research.

Looking at the overall market in order to determine an average mint price is a good starting point.

However, bear in mind that not all NFTs and NFT projects are the same.

Not only is there a big difference between an OG project from the early days and one that is being launched today, but it’s also important to compare apples to apples.

If you’re an unknown artist, there’s little point in using established artists as your reference point when figuring out how to price your NFT art.

Launching an NFT project that is trying to build a play-to-earn game is entirely different from a project that aims to become a pop culture metaverse brand.

It’s important to know who you are, what you’re good at, and what your immediate peers were able to achieve.

Here’s a checklist of things to look out for during your research:

- Am I creating art or am I building a company?

- Has my idea been done before?

- How are similar project priced right now?

- What was the mint price of these projects?

- What did the market look like when they minted?

- Does the founding team have members with lots of reach?

- Did the projects have influencers as early investors?

- What are these projects promising investors?

- How high is the project’s NFT royalty percentage?

These are just some examples of things you might want to keep an eye on before you decide on how to price your NFTs.

What Is the Objective of Your NFT Project?

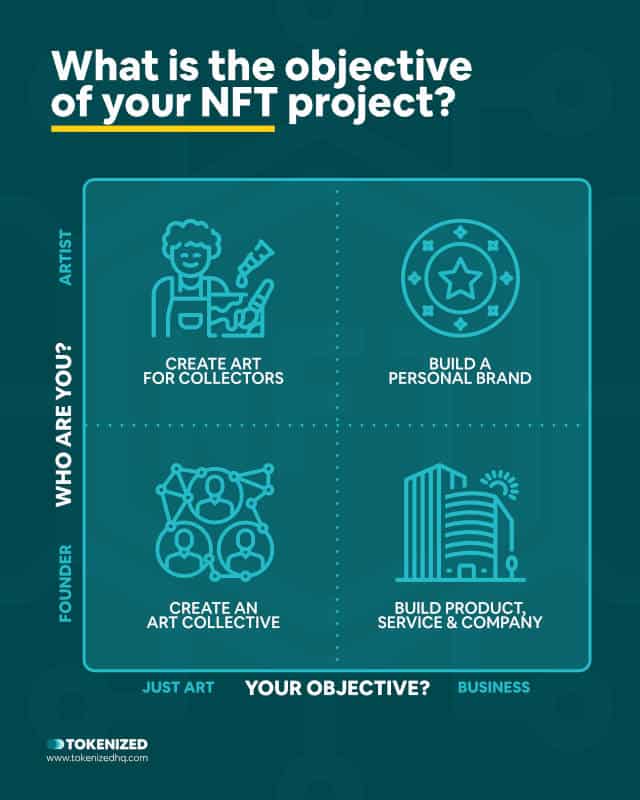

The objective of your NFT project will largely dictate how to price your NFTs. Creators should be honest and clarify for themselves whether they want to focus on creating artwork or building products and services that eventually become a company. The more commercial your project is, the higher the expectations and pressure from investors will be.

There’s no simple way to determine how to price your NFTs.

However, there are 2 fundamental questions that you can ask yourself that will help determine the overall approach you should take.

- Are you an artist or a founder?

- Do you want to create art or build products?

These two very simple questions are critical because they help you understand who you are, what your skillset is, and what you are trying to achieve.

Obviously, nothing is stopping artists from building products and founders can focus exclusively on art.

However, what you choose will ultimately dictate how to price your NFTs.

There’s a lot of focus on “utility” within the NFT space and that can become dangerous for artists who just want to create art.

Your NFT pricing strategy will need to be very different from a bigger NFT project because building teams and products requires significantly more capital.

And higher prices lead to higher expectations from NFT investors.

So before you dive into overly complex NFT pricing models, ask yourself what you want to achieve and adapt accordingly.

How to Price Your NFT

Artists focusing exclusively on their artwork should avoid generating the expectation of any utility by choosing over-ambitious NFT pricing models. At the same time, founding teams that plan to build products and services must strike a balance between raising sufficient initial funds to get going and generating creator royalties from secondary sales that are re-invested into the project.

In the following two subsections, we will try to provide some basic guidance on how to price your NFTs.

This assumes that you’ve already done the necessary research and have determined what your ultimate objective is.

None of this is etched in stone nor will it guarantee any success.

We are simply trying to provide a framework that will help you make the right decisions for your own NFT project.

NFT Pricing Strategy for Artists

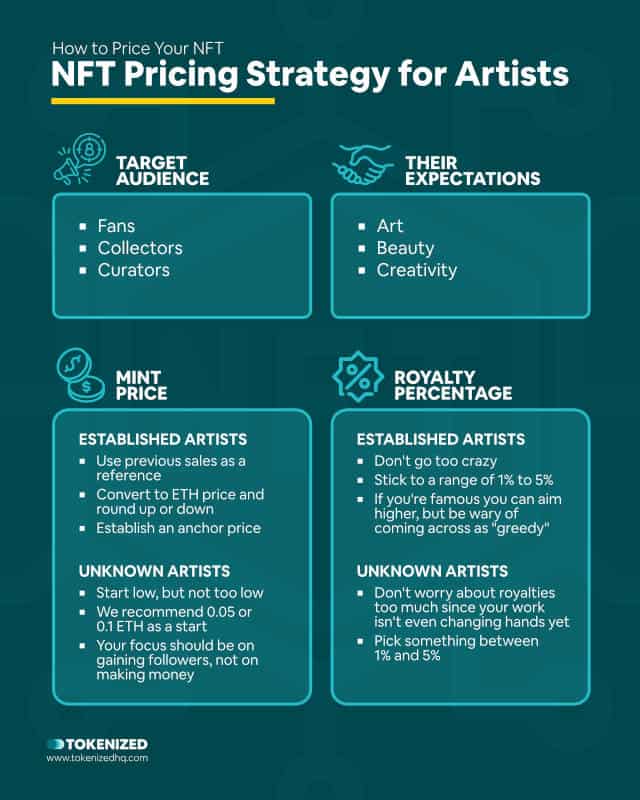

The following guidance assumes that you are an artist or at least want to focus your efforts primarily on creating art.

Focusing on artwork and being very upfront about it will ultimately make your life a lot easier because it reduces the pressure to “deliver” and lets you let your creativity reign free.

Your target audience is:

- Fans

- Collectors

- Curators

Their expectation should be:

- Art

- Beauty

- Creativity

1. Established Artists

If you’re an established artist or you already have a decent following that you know will purchase your artwork, we recommend establishing an initial price relative to previous sales.

In other words: Look at what your artwork currently sells for and convert it to ETH based on the average ETH price of the past 6 months.

Now take that number and round it up or down to the next logical reference point (0.08 to 0.1, 0.21 to 0.25, 0.88 to 1.0).

This helps establish an anchor price within the world of ETH prices.

We say “world of ETH prices” because most people rarely value an NFT based on the dollar equivalent.

It’s crucial that you are confident that you can make a sale at that level because only actual sales (proven by the blockchain) will provide the social proof you need.

As your artwork becomes more popular and sells for higher prices on the secondary market, you can start to increase your mint prices.

In terms of royalties, we recommend that artists don’t go too crazy and try to stick to a range of 1% to 5%.

If you’re relatively famous you can easily go higher but do bear in mind that this is often perceived as “greedy” and may create the expectation that you provide more “value” to your collectors.

2. Unknown Artists

If you’re an unknown artist or just starting out, then things are a bit different.

Your style might be great and your skills as well, but that’s not the only thing that counts in the art world.

You need to gain some fans first and most importantly, people who are willing to pay for your art.

Initially, there will be no demand, so you cannot command any credible price levels.

At the same time, you also don’t want to degrade the perception of your artwork by pricing too cheaply.

We recommend you start off with prices around 0.05 or 0.1 ETH.

Obviously, depending on the price of Ethereum, this could easily go into the hundreds of dollars.

However, if you set your price too low, we believe it will negatively impact perception.

Don’t worry too much about royalties at this stage since your work isn’t changing any hands anyway.

Just make sure you don’t set it too high.

NFT Pricing Models for Founders

If you’re a founder or group of co-founders then the question of how to value your NFT project is very different.

Great artwork will most definitely be part of your plan as well, but if you’re trying to build something bigger then it’s most likely more of an element of your marketing strategy.

That’s not to say that the artwork isn’t important, especially if you’re building a pop culture brand.

However, since you’re most likely trying to build a business, you’re going to attract a whole different set of people with vastly different expectations than if you were a solo artist.

Bear in mind that large NFT projects some with significantly more public pressure for you to deliver on your promises.

A fully-fledged NFT project with a team is essentially like raising funds via crowdfunding for your unproven startup idea.

And most of your investors will not be battle-tested accredited investors, so prepare for potential backlash.

Your target audience is:

- Users

- Customers

- Investors

Their expectation will be:

- Utility

- ROI

- Access

- Entertainment

1. The Mint Price

There are 2 core elements to your NFT pricing strategy when you launch.

The mint price, as well as the creator royalty, should be chosen carefully based on how strong your value proposition really is and whether you can truly deliver or not.

However you choose to price your NFTs, you will be compared to some of the best NFT projects that minted for close to nothing.

So before you try to raise as much cash as possible on the primary sale, consider public perception and think about what might be the better and fairer deal in the long term.

Here is some guidance on common mint price points:

- Free: This is not uncommon. You can compensate with royalties.

- 0.05-0.3 ETH: Mostly considered a standard mint price.

- 0.3-0.5 ETH: Not necessarily outlandish but you may have to justify it.

- 0.5-1.0 ETH: This is already in slightly “greedy” territory, unless you have a track record.

- >1.0 ETH: Unless you’ve front-loaded the project with value, the public will destroy you.

2. The Royalty Percentage

If the “mint price” of an NFT project is the like the IPO price, then your royalty percentage is your monetization strategy.

NFT royalties are the revenue stream that will allow you to continue to invest in the company and create value for your holders.

Remember, you are creating a product or service for your holders, not just a piece of art that they can hang on their walls.

The more value you provide, the most desirable the NFTs become and the price will go up.

The higher the price goes, the more royalties you will receive and thus the more value you can provide to holders.

It’s important to strike a balance that will help you meet your investment needs but not stifle trading activity.

Here’s a very rough guide on royalties:

- 0%: Rarely makes sense for founding teams.

- 2.5%: Low royalties promote more trading and generally looks less greedy.

- 5%: A good balance that is generally accepted as reasonable.

- 10%: Promotes HODLing, reduces trading. Can be perceived as greedy. Make sure you re-invest heavily!

These aren’t fixed rates, so feel free to pick something in between if it seems more reasonable in your particular case.

What Drives the Value of an NFT?

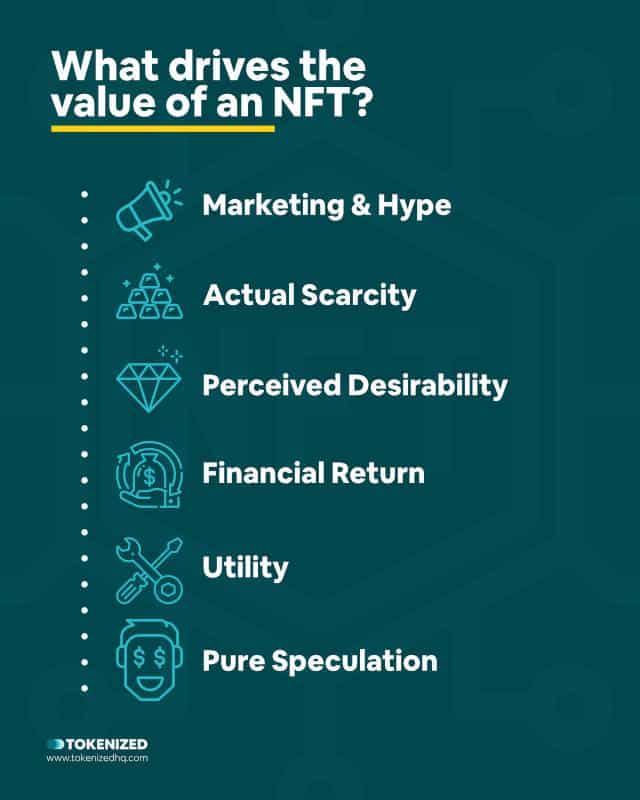

The market price of an NFT is influenced by a wide range of factors, both objective and subjective in nature. They include Marketing & Hype, Actual Scarcity, Perceived Desirability, Financial Return, Utility, and Pure Speculation.

This is not going to be a debate on whether NFTs should be worth anything or not.

We’re not interested in ideological discussions which only revolve around entrenched opinions about what is fair and just.

If you want to determine the fair market value of an NFT you have to be somewhat agnostic regarding what is right or wrong.

In the NFT space there are a number of factors that drive the value of a project or token:

- Marketing & Hype

- Actual Scarcity

- Perceived Desirability

- Financial Return

- Utility

- Pure Speculation

We could probably write an article on each one of these topics, however, in the interest of time, we’ll keep things brief.

1. Marketing & Hype

Let’s face it. Marketing and hype play a significant role whenever it comes to pricing a hot new topic.

We saw it during the ICO craze of 2017 when projects that were complete vaporware managed to raise millions based only on a website and a whitepaper.

A professional marketing website and decent whitepaper can go a long way in convincing investors to pour in their money.

This is particularly dangerous when combined with the herd mentality of the masses and the fear of missing out.

In the world of NFTs, a professional website and NFT roadmap (pitch deck) with some great-looking art can go a long way as well.

Especially if you manage to win some influencers as lead investors.

2. Actual Scarcity

Despite all the marketing and hype, actual scarcity does play a role in valuing NFT projects as well as individual tokens.

You can actually see this unfold right now as the number of NFT projects is going through the roof.

There simply isn’t enough demand for all of these projects, so the prices are going down across the board.

The same is true within individual projects themselves, where an uneven distribution is baked into the NFT pricing strategy.

Objectively rarer NFT traits are priced higher by the market than those that are very common.

3. Perceived Desirability

The attractiveness of certain traits, popular artists, or historical projects is a different version of scarcity at play.

Within our culture, not everything that is objectively rare is necessarily popular.

The more individualistic we become, the more likely we are to attach value to various things.

And the more sought-after something or someone is, the greater our willingness to pay a premium.

This especially holds true for anything that allows us to attain a higher perceived social status within the community that we care about.

How else can you explain some of the most expensive NFTs sold?

4. Financial Return

Many NFTs also have higher value because they come with the promise of a financial return.

By financial return, we don’t mean the increase in the value of the token itself but rather a particular yield that the token might generate.

For example, within the CyberKongz NFT project, there is a small subset of tokens called “Genesis Kongz”.

These Genesis Kongz generate 10 units of the project’s native token $BANANA.

$BANANA may sound funny to you, but they have actual utility within the CyberKongz ecosystem and must be purchased unless you hold a Genesis Kong.

This limited and exclusive supply and the demand for utility within the ecosystem give the token a market price.

And the higher the price of $BANANA, the more valuable a Genesis Kong becomes.

The market is surprisingly efficient in determining these prices.

5. Utility

Utility is a term that’s been thrown around a lot recently and it’s been overused mainly due to a lack of categorization of different types of utility.

A financial return is a form of utility and so is access to an exclusive circle of people.

Some utility is observable and can be valued objectively while other examples of utility are highly subjective and essentially in the eye of the beholder.

Nevertheless, perceived utility, whether now or in the future, will eventually become the dominant factor in determining the long-term price target of an NFT project.

6. Pure Speculation

One of the biggest factors of short-term (!) price movements of an NFT is speculation.

By speculation, we don’t necessarily mean investors who believe that the project will significantly increase in value over time.

We’d probably throw that into the “hype” category.

However, there are many day traders who are not really interested in being long-term holders and don’t necessarily care about their utility.

Day traders speculate that hype and FOMO will lead to extreme price movements and when the market gets too hot, they sell for a profit.

Conclusion

With so many people trying to get into NFTs yet so much uncharted territory, it’s no surprise that artists and founders are looking for guidance on how to price your NFTs.

It’s important to bear in mind that the NFT market has already gone through insane highs as well as many rough patches.

It has also attracted a whole different set of people who may not be battle-tested crypto investors.

Keep reminding yourself that this is a risky game, empathize with your audience and be realistic about what you trying to achieve.

Here at Tokenized, we want to help you learn as much as possible about the coming NFT revolution. We help you navigate this fascinating new world of non-fungible tokens and show you how you can integrate tokenization into your own business.