Want to know what your NFTs are worth?

Or perhaps you’re looking for a tool that will help you track an NFT price of your NFTs?

No problem, because we’ve done the research and there are solutions to both of your problems.

In this guide, you’ll learn how to estimate the current market price of your NFTs as well as what tools can be used to track their daily price.

And for those of you who are simply trying to find the current NFT coin price, we’ve got you covered as well.

Let’s get right to it.

Key Points (tl;dr)

- Most investors you get started in NFTs eventually get so addicted, that they feel the need to check the price of their tokens every day.

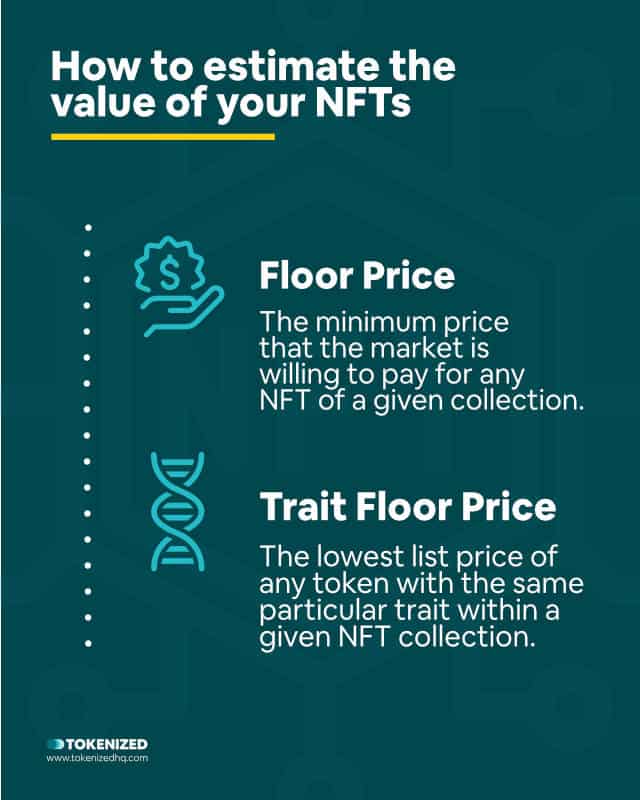

- There are too generally accepted ways of quickly estimating the price of your NFTs. Either with the Floor Method or the Trait Floor Method.

- The best place to check an NFT price right now is on OpenSea because it is the marketplace with the highest lquidity.

- There are several premium NFT tools which allow you to track portfolios and get more detailed analytics.

Like this content? Then share it!

NFT Price Tracker: How to Check the Price of Your NFTs

www.tokenizedhq.com

Here’s the answer. Great article by @ChrisHeidorn right here: https://tokenizedhq.com/nft-price/

Why NFT Investors Are Tracking Prices?

While cryptocurrencies are slowly gaining more widespread adoption, NFTs have become the hot new market for ultra-risky investments. The risks are substantial, but so are the rewards. This is why more and more NFT investors want to know how to check the current price of their NFTs at any given time.

NFTs have grown exponentially in the past 12 months.

Accordingly, public sources the NFT market size has grown from just under $100 million in 2020 to nearly $25 billion in 2021.

This new gold rush was in part triggered by the most expensive NFT sales in 2021 and 2022.

Many investors who have traditionally focused on the cryptocurrency market have grown slightly bored by all the technical talk about distributed ledgers.

In that sense NFT art and collectibles aren’t just refreshingly fun, they’ve also outperformed the crypto market by quite a margin.

That is also why many people are increasingly asking themselves: Is NFT a good investment?.

Those who dove in dead first have become addicted to checking the current NFT prices of their portfolio every day.

And let’s be blunt: They don’t just go up all the time!

How to Estimate the Value of Your NFTs

You can estimate the value of your NFTs by checking the current floor price of the collection on OpenSea. It is advisable to use OpenSea because it aggregates the most supply and demand. For a more optimistic valuation, you can also look at the floor price of a given trait that your NFT has.

NFTs are a very new asset class and while their “uniqueness” is what makes them so special, it is also the reason why it’s not always easy to value your NFTs.

You see, most NFTs are art or collectibles which derive their value from subjective preferences, objective rarity and public perception.

The NFTs themselves rarely have any intrinsic value from the outset.

They have value because enough people believe they are and if demand outpaces supply, the price goes up.

However, not every NFT within a collection of 10,000 tokens has the exact same value.

Some are objectively rarer because they have very rare traits in their image, while others are considered “prettier” merely due to the artwork.

Even amongst equally rare traits, some traits are simply more popular than others and therefore have a higher price.

There are 2 simple methods to quickly get an NFT price:

- Method 1: Collection Floor Price

- Method 2: Trait Floor Price

Method 1

The simplest and most conservative valuation is to simply look at the current OpenSea floor price of the collection on the biggest NFT marketplace in the world: OpenSea.

Since that is the most liquid market, it gives you a good indication of what price you would get for your NFT if you wanted to sell it more or less immediately.

Method 2

The second method makes sense if you aren’t necessarily looking to sell your NFTs immediately and want a slightly more optimistic valuation of your NFTs.

Go to the collection’s page on OpenSea and then filter the collection by “Buy Now” listings as well as one of the rarer traits of your NFT.

If you sort the results by price from lowest to highest, this will give you the “Trait Floor” for that trait.

What this means is that based on all current listings, if someone wanted an NFT with that exact trait, they’d have to pay at least that price.

The results will vary depending on which trait you choose, therefore it’s important that pick a trait that is at least somewhat popular amongst buyers.

Where Can You Check the Price of Your NFTs?

You can check the price of your NFTs directly on high-volume marketplaces such as OpenSea or on NFT collection rankings provided by websites such as CryptoSlam. If you want to estimate the price of your rarer NFTs, you can also use Rarity Tools to filter by traits.

Technically you can visit any NFT marketplace and check the floor NFT price of a collection.

However, we recommend that you only do this on OpenSea right now, simply because most of the other NFT websites with marketplaces simply don’t have enough liquidity.

The problem with low liquidity is that floor prices are less likely to reflect the actual market price.

That’s why you should stick to marketplaces with very high sales volume.

Alternatively, you can also check NFT collection rankings on websites such as CryptoSlam.

Sites like CryptoSlam often come with the added benefit of not only listing Ethereum-based NFTs but also those from other blockchain markets, including Solana, Ronin, Avalance, Flow and many more.

Tools to Track the Price of your NFTs

While there are free tools available, most of the NFT tools that allow you to track your portfolio and conduct more detailed analysis require premium subscriptions with varying price points. For most investors, it makes sense to pay for these tools since they come cheaper than the gas for most transactions.

There are a number of tools that are designed to help you manage and track your portfolio and NFT prices more easily.

Most of them come with some free features, however, these are usually quite basic and don’t add much value beyond what other free sites do.

Oh, and in case you were wondering, they usually fetch the data directly via an OpenSea API key.

If you want a lot more control and especially more insights into NFT analytics which will help you choose the right time to buy and sell NFTs, then you’re going to have to pay for a premium NFT analytics tool.

There are a number of popular tools on the market, each with its own set of cool features.

- Ninjalerts: A great little app that allows you to set up alerts for any Ethereum contract or wallet.

- Moby: This is an NFT analytics tool that provides you with live sales and mint data and also allows you to set up alerts.

- wgmi.io: If you have a bigger portfolio of NFTs, this tool will help you track and value all your NFTs based on the floor or trait floor prices.

- Icy Tools: This is our tool of choice because it provides a very visual way of assessing price movements of NFT collections.

All of the above tools have premium services available at different price points.

The Current NFT Crypto Token Price

en" dir="ltr">ConclusionNFTs are the hot new kid on the block amongst investors in risky digital assets.

Pretty much anyone who has ever bought at least 1 NFT in their life, invariably ends up checking the price of their tokens on a daily basis.

There are different ways how you can check the NFT price manually for free.

However, there are also various paid tools that provide you with significantly more insights which are particularly valuable for NFT investors.

Here at Tokenized, we want to help you learn as much as possible about the coming NFT revolution. We help you navigate this fascinating new world of non-fungible tokens and show you how you can integrate tokenization into your own business.