So you heard that someone actually sold their home as an NFT?

Or perhaps you’re curious how NFTs could potentially revolutionize the real estate industry?

Well, you’ve come to the right place because we’ll help you demystify the world of NFT real estate and explain the fundamental differences between digital or virtual real estate and physical real estate sold via NFTs.

In this guide, you’ll learn how NFT real estate currently works, how it could eliminate bureaucracy and potentially introduce new business models to the world.

Let’s dive right in.

Key Points (tl;dr)

- NFT real estate can represent both physical real estate in the real world or digital plots of land in the metaverse.

- Virtual real estate NFTs can be anything from plots of land to buildings which only exist within a particular virtual world or game.

- Physical real estate can be tokenized and represented in the form of an NFT, however it requires additional structuring since deeds cannot be linked to an NFT under current US legislation.

- The first official NFT house was sold in Gulfport (Florida) in February 2022.

- Hypothetically, real estate NFTs could be used as collateral for NFT loans in the future.

Like this content? Then share it!

NFT Real Estate: Everything You Need to Know in 2023

www.tokenizedhq.com

Here’s the answer. Great article by @ChrisHeidorn right here: https://tokenizedhq.com/nft-real-estate/

What Is NFT Real Estate?

There are two types of NFT real estate: Physical and Virtual. Ownership of physical real estate (such as a house in Virginia) can be linked to an NFT via tokenization. Virtual real estate, however, is usually a plot of land within a digital world such as The Sandbox or Decentraland (also referred to as the “metaverse”).

It’s important to note that when people talk about NFT real estate or real estate NFTs, not everyone is necessarily talking about the same thing.

Some are referring to physical real estate being sold in the form of an NFT, while others might mean digital real estate inside virtual worlds (also known as the “metaverse“).

This is an important distinction because the motivations associated with NFT houses and plots of land within a game are fundamentally different.

In the following sections, we’ll shed some light on how these different types of NFT for real estate work and what the benefits of each of them are.

- How Does Virtual Real Estate Work?

- How Do NFTs Work in Physical Real Estate?

How Does Virtual Real Estate Work?

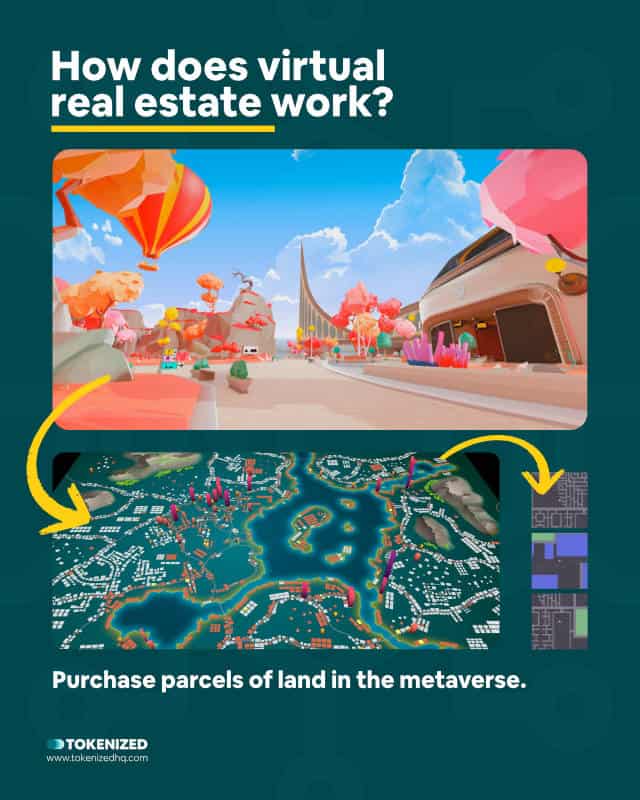

Virtual real estate is plots of land or building within virtual worlds where people spend a significant portion of their free time. These properties can be acquired by purchasing the associated NFT in exchange for cryptocurrency. Depending on the type of virtual, these properties may come with benefits that have a monetary value.

The primary focus of this article is NFTs that are linked to physical real estate.

If you are interested in learning more about virtual real estate, you’ll be happy to hear that we are working on a dedicated article on this topic.

However, let us briefly explain what digital real estate or metaverse real estate is.

With the advent of social media, humans are spending increasingly large amounts of time online.

For many people, social interaction within online communities of like-minded people has become significantly easier than in the real world.

While opinions on the metaverse may vary, it’s safe to say that these virtual online worlds will continue to grow as humans seek to communicate with others.

Popular platforms for such virtual worlds include Minecraft, Roblox, Decentraland, The Sandbox, NFT Worlds and many more.

And believe in it or not, you can literally acquire plots of land within these worlds.

For example, Decentraland has 90,601 individual plots of land and they can be purchased using their native currency MANA.

While this all might sound crazy to you, do not underestimate how many people are already spending time in these virtual worlds.

In fact, you can even buy digital ad space within them and some people are making money with NFTs by acquiring valuable ad space.

Anyway, as we mentioned earlier, we’ll be covering the metaverse as well as digital real estate in a lot more detail in a separate article.

Let’s now have a look at some real physical property, tokenized as NFT real estate.

How Do NFTs Work in Physical Real Estate?

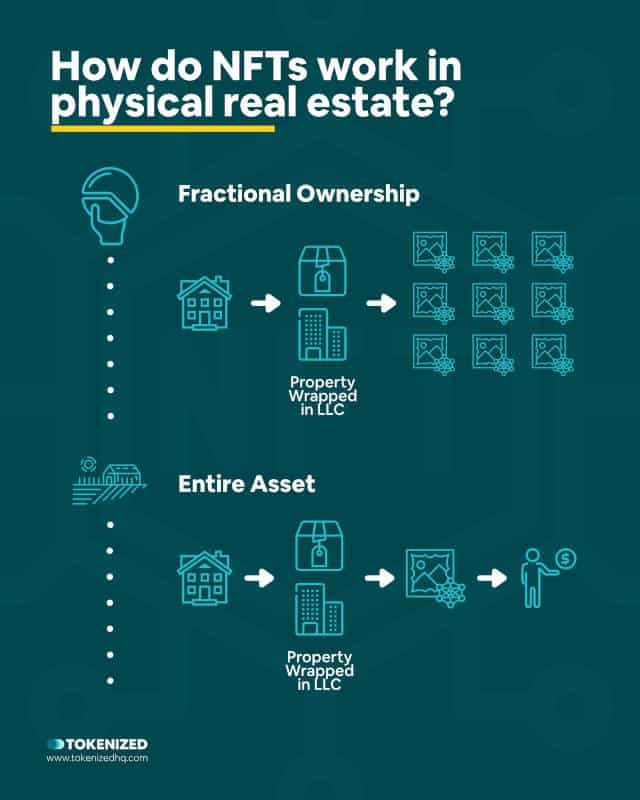

Physical real estate can be tokenized either as an entire asset or via fractional ownership. This is achieved by “wrapping” the asset into a legal entity and ownership of this entity is then represented by an NFT or a certain number of tokens.

Real estate NFTs essentially work just like any other NFT.

You buy them using cryptocurrency and they are held within a digital wallet.

However, many people wonder how you can link a physical asset to an NFT.

This is a fair question because when you buy an NFT you are merely acquiring a digital asset on a blockchain.

There are 2 ways in which real estate can be tokenized:

- Entire Asset Tokenization (EA)

- Fractional Ownership Tokenization (FO)

Fractional Ownership

Fractional ownership tokenization is relatively simple and similar to crowdfunding.

Depending on how the investment is structured, each owner may hold one or more fractional shares of the underlying real estate.

These shares can be represented in the form of NFTs or regular tokens as well.

Websites like JuiceBox already allow large groups of people (e.g. DAOs) to pool their funds and jointly bid on assets.

This has been done with famous artwork (e.g. AssangeDAO or ConstitutionDAO) and can easily be done with real estate as well.

You would probably have to wrap it into some form of a legal entity, but that’s not uncommon and requires the tokens to be registered with the SEC.

Entire Asset

Entire asset tokenization is slightly more complicated though.

Most developed countries currently structure and document real estate ownership via a deed’s office.

This only works if the actual property deed is turned into an NFT.

Lawmakers could pass legislation that creates a newly regulated asset class that allows for deeds to exist in the form of an NFT.

However, for the time being, this is not easily possible.

The only way to do so right now is to “wrap” the real estate into a legal entity and create a single NFT token that represents ownership in that entity.

And guess what…somebody did just that.

The First Home Sold as an NFT

The first successful sale of a US-based house as an NFT was announced in February 2022. Leslie Alessandra sold her home in Gulfport (Florida) for $650,000. The transaction of facilitated by the prop-tech company Propy.

In April 2021 a California real estate broker tried to auction off a piece of property as an NFT.

Since he failed to attract any bidders, the world assumed that it must have been a really bad idea.

Part of the problem was that the minimum bid was set to $2 million, which was significantly higher than the property’s market value.

However, in early February 2022, the prop-tech company Propy facilitated the very first US-based home sale in Florida as a real estate NFT.

The Gulfport home attracted more than 7,000 bidders and real estate NFT was eventually sold for $650,000.

It should be pointed out that this was exactly the type of “Entire Asset” tokenization that we spoke about earlier.

The buyer of the NFT will become the owner of an LLC, whose only asset is the house.

Of course, the necessary paperwork for the transfer of the ownership of the LLC still needs to happen in the real world.

Let’s just say, we’re still very early.

How to Use Real Estate NFTs for a Loan

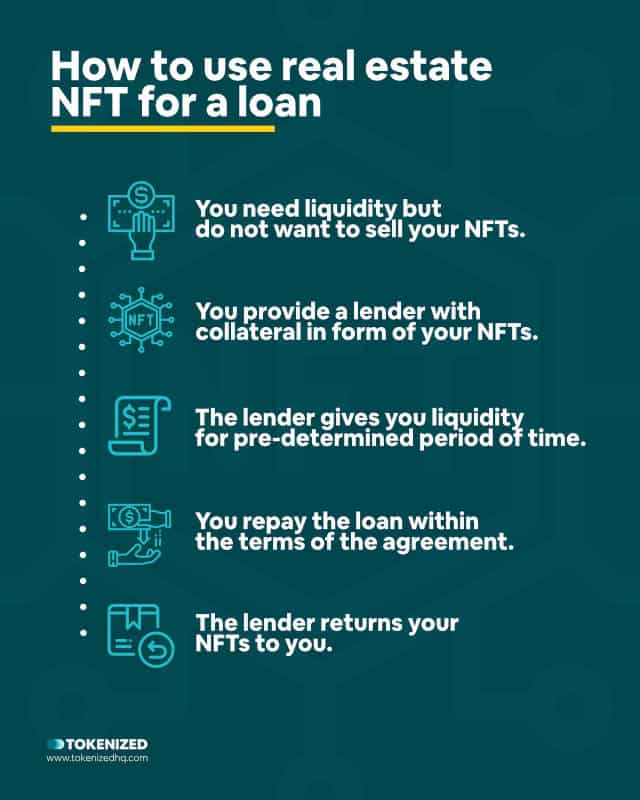

NFTs that have a market value can be used as collateral in order to obtain a cryptocurrency loan. The same is technically possible with real estate NFTs as well. As long as the NFT and its underlying asset provide sufficient value, it can be used to back a loan.

One aspect of NFTs that not many people have on their radar is NFT loans.

We’ve spoken about NFT-backed loans before, however, these always involved NFT collectibles which exist exclusively in the digital world.

Nevertheless, since they have value for many people, it is possible to use platforms such as NFTfi to get a short-term Ethereum loan and provide an NFT as collateral.

The very same thing could also be done with NFT real estate as well.

Granted, there are additional complexities if there is still a mortgage on the property, but in principle, the same logic should apply.

Conclusion

Many people are quick to claim that NFTs cannot be linked to physical assets.

It’s true that legislation still has a lot of catching up to do in order to provide sound regulatory frameworks for the tokenization of assets.

However, it is absolutely false to state that it is not possible today.

Tokenization is possible, it just requires additional structuring in order to make it compatible with the “real” world.

We strongly believe that real estate is one of the industries that will benefit the most from NFTs and some incredibly innovative business models will make a lot of jaws drop.

Here at Tokenized, we want to help you learn as much as possible about the coming NFT revolution. We help you navigate this fascinating new world of non-fungible tokens and show you how you can integrate tokenization into your own business.