Are you currently considering selling some of your NFTs for liquidity?

Maybe you’re sitting on a mountain of NFTs but don’t really want to sell them?

Liquidity is one of the biggest challenges in the NFT space.

Unlike classic cryptocurrencies, the market is highly illiquid.

That’s why some startups are introducing the concept of NFT loans.

In this guide, we’ll explain exactly what NFT loans are, how they work, and what some of the most popular NFT lending platforms are right now.

We’ll show you how to get liquid again.

Key Points (tl;dr)

- The NFT market is still very illiquid, which makes it difficult to close out a position when you urgently need liquidity.

- NFT loans are innovative solution to this problem. You provide your NFTs as collateral to lenders, who in return provide you with the liquidity you need.

- NFT lending can be challenging though since their prices may fluctuate significantly and lenders may offer a very low loan-to-value ratio (LTV).

- The most accessible NFT lending platform is NFTfi, while Arcase and Nexo prefer higher value NFTs as collateral.

Like this content? Then share it!

What Are NFT Loans and How Do They Work?

www.tokenizedhq.com

Here’s the answer. Great article by @ChrisHeidorn right here: https://tokenizedhq.com/nft-loans/

Why Is Liquidity a Problem in NFTs?

Small markets with little commoditization tend to be highly illiquid and are subject to lots of volatility. While the “uniqueness” of NFTs is their core strength, they are also one of their biggest weaknesses. Since not every NFT is the same and the value of some of their traits is very subjective, it’s not easy to liquidate a position quickly.

NFTs are a lot of fun and it’s incredibly easy to get addicted to purchasing new ones.

But when you develop tunnel vision, you start seeing opportunities everywhere.

The problem is that NFTs are an incredibly illiquid asset class.

When a market is “illiquid” it means that you cannot easily liquidate your assets without a significant discount to the market price.

If you’re in a hurry, this can become a big problem.

Especially since you may have to sell an NFT which you believe will actually increase in value very soon.

Some NFT projects have introduced gamification elements that incentivize holders to either not sell their NFTs or stake them in a smart contract.

In return, the holders receive some alternative token or other items which have value within the project’s ecosystem.

These “dividends” will usually have a market value and are more easily sold due to their implied utility.

Examples of such dividends are the $BANANA token that Genesis Kongz holders earn every day or the $MILK token of the Cool Cats project.

But now there’s a new solution to the “liquidity problem”.

Now you can take out a loan on your valuable NFTs.

What Are NFT Loans?

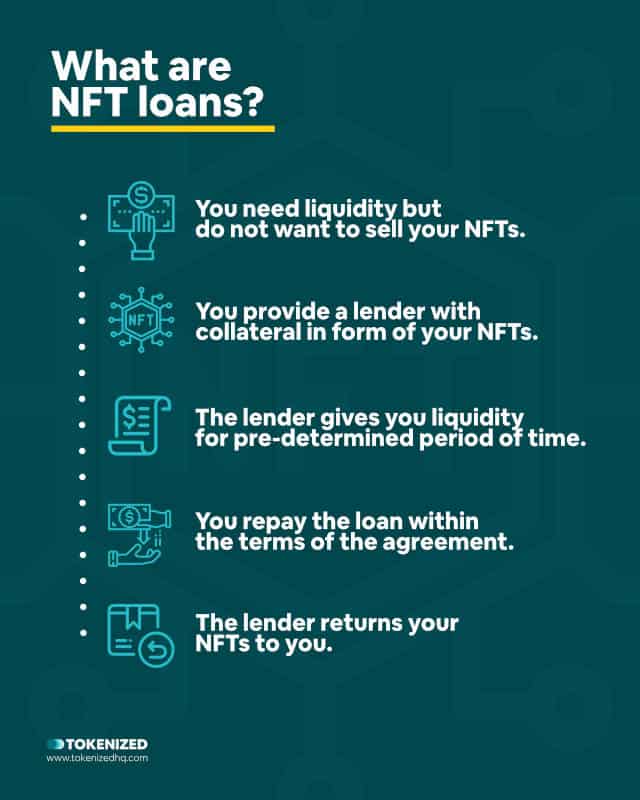

NFT loans are basically collateralized loans with NFTs. Depending on the type of NFT and its qualities as a store of value, you are able to take out loans at different loan-to-value (LTV) ratios. If you fail to repay the loan, the lender keeps the NFT that you provided as collateral.

NFTs are proving to be an excellent gateway into the DeFi space.

DeFi has traditionally been limited to the nerdier crypto aficionados who enjoy figuring out the minute details of yield farming.

But with NFTs, this is slowly changing.

People who aren’t inherently familiar with investment markets are discovering some of the liquidity challenges.

However, it is now possible to take out a loan on your valuable NFTs, similar to how you could put a mortgage on your house.

Actually, if you were to tokenize your home into NFT real estate, you could even do it with your house.

The technical term for this type of NFT lending is “NFT collateralized loans” or “NFT backed loans”.

In other words, these NFT lending platforms allow you to borrow against NFTs.

So let’s say you owned a CryptoPunk or a Bored Ape and it was worth $500,000.

You could probably take out a loan at a loan-to-value (LTV) ratio of 80%.

That means you would receive $400,000 from the lender and your NFT would serve as collateral for the loan.

If you don’t repay the loan, the lender keeps the NFT.

For lenders, this obviously provides an indirect way how to make money with NFTs.

Why Are NFT Loans a Challenging Market?

Due to the illiquid nature of the NFT market, it is not always easy to value an NFT. In most cases, you will not be able to get more than the current floor value adjusted for risk. This is something you must account for before taking out a loan on your NFTs.

The main challenge with NFT loans is that not every NFT is the same.

I think we can all agree that CryptoPunks or Bored Apes are relatively safe assets.

Of course, their value fluctuates as well, but they are so sought after that the risk of devaluation is fairly limited.

If you own one of these NFTs, that’s great, but what if you “only” own a Lazy Lion NFT?

Well, your prospective lender might consider it a lot riskier.

Remember, if you don’t repay your loan, the lender is stuck with your NFT.

If the value of Lazy Lions has since dropped, he’d be making a loss.

Therefore the LTV he offers you might not be 80% but rather 20%.

This is essentially his risk-adjusted valuation of your NFT and if you don’t repay, he’ll probably make a bargain.

What sort of LTV you agree to will largely depend on market dynamics.

Are you in a rush? Do you need cash?

That’s not a good position to be in.

What are some NFT lending platforms?

There are a number of different NFT lending platforms.

This is quite different from the NFT rental market, which is still at a much earlier stage.

Some of them have already received significant investments from venture capital firms.

“Arcade” recently raised $15 million in their Series A.

Let’s have a look at some of the most popular platforms:

Arcade

Arcade is currently mainly targeting institutional lenders and high net worth individuals.

The platform earns a percentage on every transaction.

Borrowers can also bundle together multiple NFTs when they apply for collateral, which saves gas fees on the loan transaction.

Arcade currently supports a “relatively” long list of smart contracts, not just CryptoPunks and Bored Apes.

Nevertheless, the list is limited.

Projects like Cool Cats or Veefriends currently don’t make the list.

NFTfi

NFTfi lets you put up pretty much any ERC-721 token for collateralization.

Whether you’ll get a loan or not mainly depends on the willingness of lenders.

The NFT is locked in an NFTfi smart contract once the borrower accepts the lending proposal provided by the lender.

The lender then receives interest on the loan until the borrower has repaid the debt.

Nexo

Nexo is a centralized platform that also offers lending solutions.

Unlike some of the other platforms, they do not offer lending on riskier NFT assets.

Currently, they only support CryptoPunks and BoredApes as valid collateral.

This approach is primarily attractive for whales with huge portfolios of high-value NFTs.

But if you’re one of those, you’ll even get your personal account manager.

Drops

Drops is another NFT lending platform.

Unfortunately, we haven’t been able to figure out how exactly their platform works.

Their app hasn’t recognized any of our NFTs so far, so it’s difficult for us to really test their services.

They also seem to be 100% decentralized and somewhat opaque.

Therefore we recommend, as always, that you do your own research.

Conclusion

One of the biggest challenges in the NFT market right now is the lack of liquidity of these new assets.

However, there are innovative DeFi solutions available, which will allow you to take out a loan on your higher-value NFTs.

If you fail to repay your loan, the NFT that you provided as collateral will remain with the lender.

It is therefore paramount that you are sure that you can repay the loan at maturity.

Here at Tokenized, we want to help you learn as much as possible about the coming NFT revolution. We help you navigate this fascinating new world of non-fungible tokens and show you how you can integrate tokenization into your own business.