Are you wondering whether you need to file OpenSea taxes for your NFTs?

Or perhaps you already know that you do and you’re just looking for the best tools to help you with your OpenSea tax reporting?

Well, don’t worry, because taxes are something that most people didn’t have on their radar when they go into NFTs and you’re not the only one looking for answers.

In this guide, you’ll learn whether you need to pay taxes on OpenSea, how much you might be liable for, and which tools can help you remain compliant with the IRS and other tax authorities around the world.

Let’s get right to it.

Key Points (tl;dr)

- To be clear: Income and other gains generated from creating, selling, and trading NFTs are always subject to taxation, just like regular cryptocurrency.

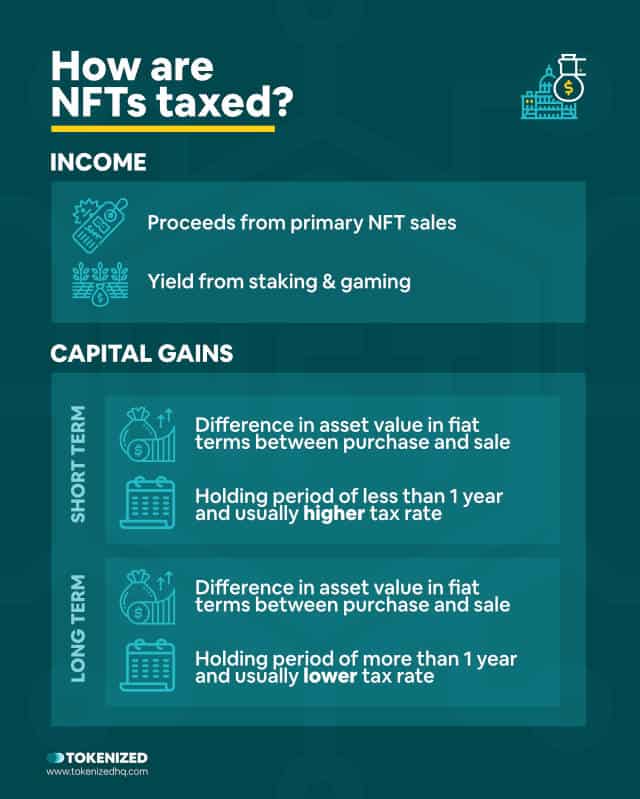

- The relevant types of tax for NFTs on OpenSea are income tax and capital gains tax (short term and long term).

- Most countries distinguish between the same types of taxes, however, the rate at which they are taxed and when they apply will usually vary from country to country.

- While the IRS doesn’t have direct blanket access to user data on OpenSea, the terms of service already provide OpenSea with the right to share specific user data in order to comply with regulations.

- The top 6 tools that can help with your OpenSea tax reporting are:

- CoinTracker

- CoinLedger

- CryptoTax Calculator

- TokenTax

- Koinly

- CoinTracking

For a complete list of the best OpenSea tax reporting tools, PLEASE READ THE FULL ARTICLE.

Like this content? Then share it!

The Top 6 Tools to File OpenSea Taxes in 2023

www.tokenizedhq.com

Here’s the answer. Great article by @ChrisHeidorn right here: https://tokenizedhq.com/opensea-taxes/

Do You Pay Taxes on OpenSea?

Yes, in the US you have to pay taxes on income and capital gains generated from NFT trading. The rules differ slightly from country to country, but in principle, NFTs are taxed in almost every country around the world.

Believe it or not but many people who made quite a bit of money with NFTs last year had relatively little prior experience with cryptocurrencies.

That’s why it’s not particularly surprising that there have been tons of questions around OpenSea taxes.

Many people simply do not realize that NFTs are taxable and that the burden of proof is upon you.

And even though the public nature of the blockchain should technically make NFT tax reporting quite easy, the sheer amount of taxable events can quickly become overwhelming.

That is why we strongly advise you to handle your OpenSea taxes via one of the many sophisticated crypto tax tools.

How Are NFTs Taxed?

NFTs are taxed in a similar way to cryptocurrency, however, since NFTs are non-fungible, each token is usually considered a separate asset with its own tax history. Depending on the exact circumstances, your gains will be classified as income, short-term capital gains, or long-term capital gains. Precise rules and tax rates will differ from country to country.

While the rules are usually different in every country since each country, there are some common elements in nearly every jurisdiction.

For detailed information on how NFTs are taxed in your specific country, please consult a professional tax advisor.

However, you can assume that OpenSea taxes will be handled in similar ways in most developed countries.

Most countries differentiate between 3 rough cases:

- Income

- Short-Term Capital Gains

- Long-Term Capital Gains

1. Income

So what exactly constitutes income?

Well, usually anything that can be interpreted as a form of payment for a service or a yield on an asset.

For example, income generated from mining is generally considered income and the same is usually the case for yield that you earn from staking your NFTs.

The same applies to income from primary sales of an NFT that you created.

So, if you’re an artist and have been selling NFTs then all those proceeds will be part of your OpenSea taxes.

In most cases, this income is added to your overall income for taxation purposes.

2. Short-Term Capital Gains

Capital gains are a bit different from income because they are only related to the difference between the price at which you purchased or received an asset, and the price that you sold it for.

In other words, if you bought at an NFT for $1,000 and sold it for $2,000 then you had capital gains of $1,000.

Bear in mind that it doesn’t matter how much ETH you paid or received, what matters is the fiat value.

So technically you could have made a loss in ETH terms yet still be liable for capital gains tax based on the fiat value.

Capital gains are usually considered “short-term” when there is less than a year between taxable events.

3. Long-Term Capital Gains

Capital gains are usually considered “long-term” when more than a year has passed between taxable events for a given token.

This distinction is very important because short- and long-term capital gains are frequently taxed at different rates.

Offsetting gains with losses also usually only works within the same category.

So, for example, you usually cannot offset short-term gains with long-term losses and vice versa.

Does OpenSea Report to the IRS?

It is unlikely that OpenSea provides blanket access to all its user data to the IRS. However, since the passage of the U.S. infrastructure bill, it is very likely that OpenSea will be required to share specific user data with the IRS if requested.

Generally speaking, OpenSea doesn’t really need to report specific user data to the IRS since the blockchain is already public.

In many cases, OpenSea also doesn’t know who specific addresses belong to, so there is little benefit in providing the IRS with all its data.

That being said, the OpenSea privacy policy is very explicit regarding the fact that they have the authority to disclose user data in order to comply with laws and regulations.

OpenSea also reserves the right to report user transaction details to the IRS if required and this is very likely to happen given that the U.S. infrastructure bill was recently passed.

6 Tools to Help You File Your OpenSea Taxes

- CoinTracker

- CoinLedger

- CryptoTax Calculator

- TokenTax

- Koinly

- CoinTracking

We’ve put together a list of 6 cryptocurrency tax tools that will help you with your OpenSea tax reporting.

While they all share similar features, you may come to the conclusion that you find some easier to handle than others.

Here’s the list of tools to help you with your OpenSea taxes.

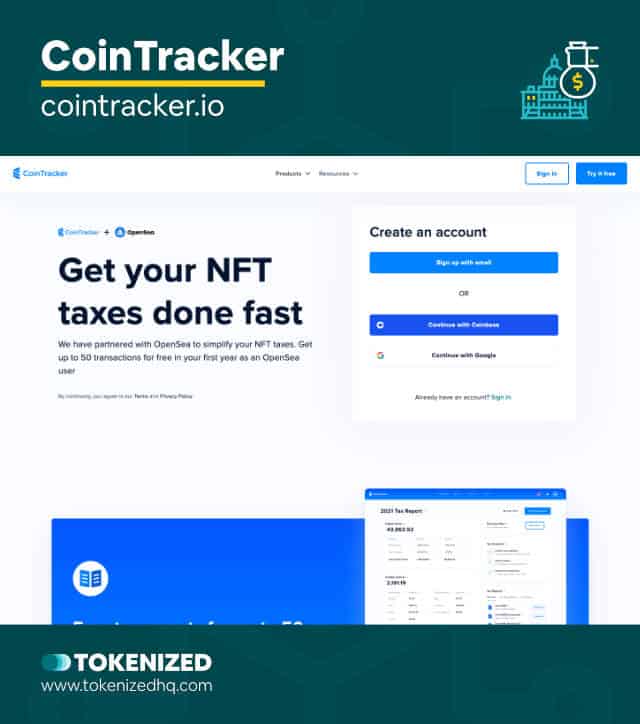

1. CoinTracker

CoinTracker is OpenSea’s recommended tax partner and they have even negotiated a special deal for their users.

If you’ve done less than 50 transactions, you’ll get your report for free and everyone else gets a 10% discount on the first year.

Although one would assume that Cointracker not only supports fungible cryptocurrencies, we were not able to find any specific information indicating that they also support NFTs.

2. CoinLedger

CoinLedger is another very popular tool for filing your cryptocurrency taxes.

As far as we can tell it comes with all of the key features that you would expect from a tool like this.

What’s great is that they also highlight that they have specific support for NFT-related taxes as well.

If you’re based in Australia, you’ll also be glad to hear that they also have support for Australian tax reporting.

3. CryptoTax Calculator

Next on our list is CryptoTax Calculator, another service provider that has strong backing from funds such as AirTree, 20VC, and even Coinbase Ventures.

With more than 500 integrations is safe to assume that they cover most of the crypto landscape and they also support NFTs and DeFi.

Interestingly enough, this Australia-based company even has support for 22 different countries around the world, including most of the EU.

4. TokenTax

If you’re keen to know more about how taxation work in the crypto space, TokenTax actually has a lot of very good reading material.

Of course, they also cover most of the features you’d come to expect, including support for DeFi and NFTs.

They primarily focus on the US but they do claim to offer relevant international gain/loss reports.

Whether these are sufficient for your local tax authorities is a different question though.

5. Koinly

Number 5 on our list of crypto tax tools for NFTs is Koinly.

Koinly supports more than 17,000 currencies, 50 blockchains, 350 exchanges, 50 wallets, and 11 specific services.

While it’s not immediately clear if they have NFT support as well, they do cover 31 different countries throughout the world, which is great.

6. CoinTracking

One of the earliest crypto tax tools from back in 2013 is the Munich-based CoinTracking.

That’s right, CoinTracking has been around since way back and has more than 1 million registered users.

Ironically, even though it is often cited as the most fully-featured tool out there, it’s definitely not the prettiest to look at.

Conclusion

Proper OpenSea tax reporting is something that every single one of us should take very seriously.

Every time to buy and sell an NFT, you are dealing with a taxable event, and depending on how much time has passed in between, your gains and losses may be short- or long-term.

Proper crypto tax reporting can be overwhelming, so it’s always a good idea to get your hands on a professional tool that helps you avoid those tax headaches.

Here at Tokenized, we want to help you learn as much as possible about the coming NFT revolution. We help you navigate this fascinating new world of non-fungible tokens and show you how you can integrate tokenization into your own business.